As a product executive, navigating the complexities of strategic decisions is a daily task. Among these, the classic “make or buy” dilemma holds significant weight. This decision impacts not just immediate product roadmaps but also long-term growth, scalability, and competitive positioning. An essential component of this strategic landscape is portfolio management through mergers and acquisitions (M&A). This article will unpack the nuances of make-or-buy decisions and highlight how M&A plays a pivotal role in shaping a dynamic and future-proof product portfolio.

The Fundamentals of Make or Buy Decisions

The make or buy decision involves evaluating whether to develop a product or feature internally (“make”) or procure it externally through partnerships, licensing, or outright purchase (“buy”). This decision hinges on factors such as:

- Core Competency Alignment: Does developing this capability internally align with the company’s core strengths, or is it better outsourced to an expert third party?

- Time-to-Market: In highly competitive environments, the speed of deployment can be a deciding factor. Internal development may take longer compared to acquiring an existing solution.

- Cost and Resources: What are the opportunity costs of building in-house? Are there sufficient resources and expertise, or would the costs outweigh potential benefits?

- Innovation and Differentiation: Can the company develop a unique product or feature that provides a competitive edge, or would buying an existing, proven solution be more strategic?

Key Considerations in Make or Buy Analysis

- Strategic Fit: The decision should be evaluated against the strategic goals of the company. If developing internally allows for unique value propositions or deeper customer integration, then “make” could be favored. However, if the market demands rapid scaling or immediate availability, “buy” may be the preferred route.

- Long-term Scalability: Consider if the internally built product will scale with future business needs. An acquired solution may come with built-in scalability that bypasses years of development.

- Intellectual Property and Control: Building a product in-house ensures full control over IP, which could be a key asset in competitive markets. Buying a solution could limit flexibility, depending on the terms of the acquisition or licensing.

The Role of M&A in Portfolio Management

Mergers and acquisitions can significantly influence the make or buy decision by expanding the company’s capabilities and offering ready-made solutions that integrate into the existing product ecosystem. Here’s how M&A can strategically enhance product portfolios:

1. Accelerated Growth and Innovation

Acquiring a company with innovative technology can jumpstart a company’s product offering, cutting down on R&D time and costs. This approach is common in tech-heavy industries where breakthrough innovations can dictate market leadership. For instance, a company seeking to break into artificial intelligence (AI) might choose to acquire a promising startup with an existing AI platform, bypassing the lengthy development process.

2. Diversification and Risk Management

M&A allows product executives to diversify the portfolio, reducing the risk associated with dependency on a narrow set of products. By acquiring solutions that complement existing products, companies can offer end-to-end solutions that strengthen market presence and reduce customer churn.

3. Tapping into New Markets

When strategic goals include expanding into new markets or geographies, acquiring a company with established local presence and customer base can be a more effective strategy than building from scratch. This provides immediate market access and often a network of relationships that would take years to build organically.

4. Synergies and Integration

M&A decisions should consider potential synergies in technology, customer base, and operational efficiencies. Successful integrations can lead to cost savings and enhanced capabilities across the product suite. This aspect requires careful due diligence to assess cultural and technical compatibility to ensure seamless integration post-acquisition.

Challenges and Best Practices for M&A in Product Portfolio Management

Challenges:

- Integration Complexities: M&A efforts often stumble due to integration difficulties. Misalignment in technology stacks or company cultures can delay synergy realization.

- Overvaluation and Financial Strain: The cost of acquisitions can sometimes be inflated due to market competition or the perceived strategic value, potentially leading to financial strain.

- Focus Dilution: Pursuing too many acquisitions can spread resources thin, impacting the focus on core products and long-term strategy.

Best Practices:

- Due Diligence and Strategy Alignment: Comprehensive due diligence ensures that the acquired company aligns with strategic goals, customer needs, and internal capabilities.

- Integration Planning: Establish clear post-acquisition plans with designated teams responsible for integration timelines and milestones.

- Preserve Innovation Culture: Where possible, maintain the acquired company’s innovative culture to avoid stifling its potential within a larger organization’s bureaucratic structure.

Case Study: Leveraging M&A for Strategic Expansion

Consider a leading software company that has historically focused on enterprise resource planning (ERP) solutions. To enhance its product portfolio and enter the rapidly growing field of data analytics, the company chooses to acquire a data analytics startup. The acquisition provides an established technology stack and team with deep domain expertise. With strategic integration, the ERP company can now offer a powerful data-driven module, enhancing its value proposition and cross-selling opportunities.

This approach allowed the company to leapfrog into a new domain without years of in-house development, exemplifying how M&A can serve as a strategic lever in the make or buy decision process.

Conclusion

For product executives, make or buy decisions represent a balancing act between leveraging internal capabilities and exploring external growth avenues through M&A. The strategic use of mergers and acquisitions can supercharge product portfolios, facilitate rapid expansion, and secure a competitive edge. However, success in this area depends on rigorous analysis, clear strategic alignment, and seamless integration practices. By carefully evaluating when to build, partner, or buy, product leaders can create robust, agile portfolios primed for long-term success.

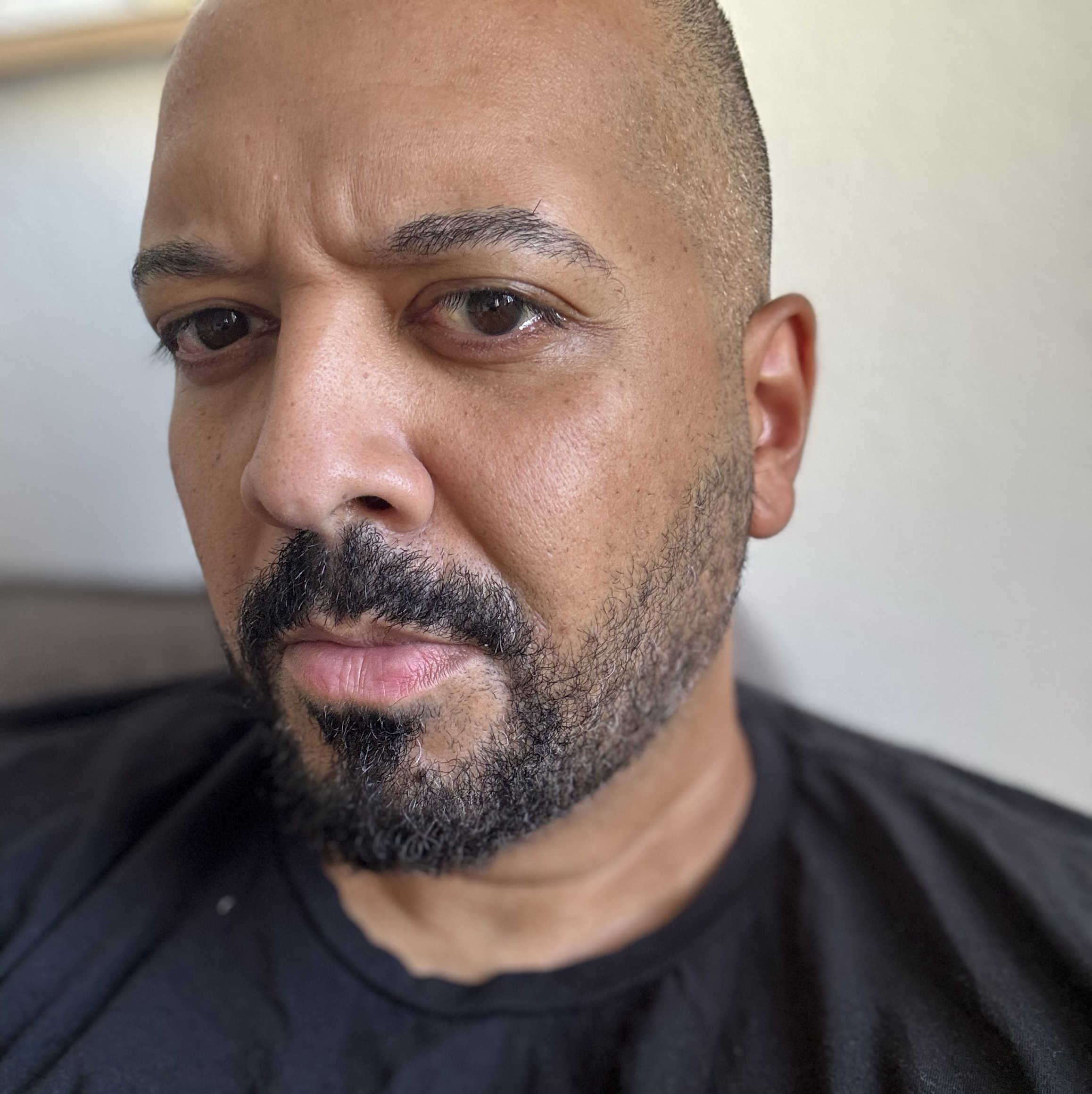

Aye Stephen is an accomplished Product Manager and currently Chief Product Officer at one of Europe’s leading eCommerce ERP solutions. With a strong background in product management and leadership coming from 20 years experience, he is an expert in building high performing product teams in agile environments and organizational change management. Stephen holds an MBA from Goethe Business School Frankfurt and an M.A. in American Studies/Media Science from Philipps University Marburg.

Leave a Reply